CHANGE IS IN THE AIR

Thursday, March 1, 2012 at 10:17AM

Thursday, March 1, 2012 at 10:17AM Exceptional Values for Late Model Cabin Class Jets

Vol. 25, No. 1 | March 1, 2012 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Change is in the air, literally. Market activity for late model large cabin class business jets is on the rise. These new or late models jets are experiencing competitive pricing. Could this be considered a price war? In addition to all of this, an increasing number of sales are bound for export to Asia. 2012 appears to be on a jump start for transactions. For buyers, this has become one of the best opportunities for acquisitions. At some point, supply will no longer be able to meet the demand for the late model large cabin jet. All of the evidence points to a not-so-soft market. As history is cyclic and the market is in a trough for values, can you guess where pricing is heading in this market segment?

For the mid-range and light jet business aircraft, values continue to slightly decline. One of the reasons is the adequate supply of inventory available for sale. Outside of pricing, these are the workhorses of business aviation. These jet segments are more impacted by the volume of well-equipped late models available for sale. Until inventories of bargain-priced jets have been eliminated, expect values to remain artificially low. Buyers no doubt recognize these great opportunities not so much as an investment in equity but a means to get the job done for revenue growth. And who knows, when artificially low pricing is exhausted by demand, it may be the icing on the cake so to speak as these values become firm.

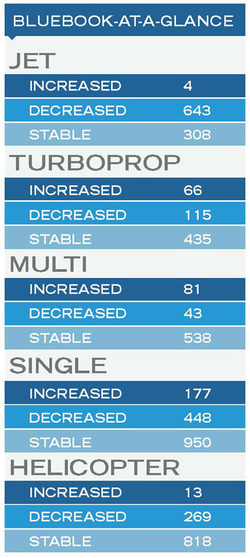

In the turboprop market, activity continues to improve while values continue experience stability. Age, condition and equipment continue to be dominating factors. At the same time, legacy turbo props, those manufactured in the 20th century, appear to be enjoying an active market. Noting the Aircraft Bluebook– at–a–Glance monitor (see chart on right), this market segment is relatively stable when compared to the previous quarter.

In the turboprop market, activity continues to improve while values continue experience stability. Age, condition and equipment continue to be dominating factors. At the same time, legacy turbo props, those manufactured in the 20th century, appear to be enjoying an active market. Noting the Aircraft Bluebook– at–a–Glance monitor (see chart on right), this market segment is relatively stable when compared to the previous quarter.

For agriculture turbo props, late model agriculture sprayers are in short supply. And, if one is shopping new, expect delays as current production is already spoken for. Pricing will continue to hold strong for these late model aircraft. Overall, this industry segment remains stable. Check your Bluebook for values.

In the multi and single piston market, values appear to be for the most part stable as displayed on the Aircraft Bluebook–at–a–Glance monitor. More opportunities for the majority of the pilot population here in the USA are represented in this segment. This means those folks who fly and maintain the “big stuff” may have one of these in their hangar for personal or business use.

This segment is also a stepping stone. For some, it is part of the transition process of moving up to more complex aircraft, and, for others, the opposite. In any case, lots of activity makes for a healthy market. For the helicopter market, the recession is over. Values are stable and there is a broad base of activity in this market segment. Two key factors that keep this industry on the go are quality of life issues that are always on the forefront: security and energy.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.

Reader Comments