Entries in used aircraft (50)

USED AIRCRAFT MARKET OFF TO GOOD START IN 2011

Tuesday, March 8, 2011 at 10:12AM

Tuesday, March 8, 2011 at 10:12AM Vol. 24, No. 1 | March 8, 2011 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Have you ever been involved in an incident when you actually made the news?

I have. No, nothing in my life as the editor of Aircraft Bluebook–Price Digest has been particularly newsworthy. But in my previous life as a 25-year veteran in law enforcement with the Kansas City, Mo., Police Department, I sure can relate.

In some cases, my experiences during a particular incident and what I later read in the news about the same incident did not match. Not to knock any journalists for their reporting skills, I am making the point that it is hard to report third-hand information.

Instead of reviewing market statistics to summarize business aircraft activity, I’m going to shoot from the hip, so to speak, and generalize my personal experiences with those I have been in direct contact with who were directly involved with an aircraft transaction.

Business has improved. The only downside to making the deal happen is that the values of yesterday in some aircraft markets are not making a comeback. Breaking it down, late-model, long-range large-cabins are competitive. I can say this because reported values are not skidding downhill. They are holding steady if not improving. Time and condition do impact value.

Looking at the mid-cabin class, sales are also rebounding, but pricing, not so much. Yesterday’s sale price is stronger than today’s. It is what it is.

Light jets and VLJs tell the same story as the mid-cabin class. Turboprops, the muscle of short hops, heavy loads and limited runway environments, are showing a good steady trend of transactions. On the topic of values, what these turboprops are worth today will be a little less tomorrow. If I had to give it a name, I would call it standard depreciation. That alibi will just about work anywhere.

Purchasing piston-powered aircraft is like buying a car. Who in their right mind would buy a new car as an investment? Reported transactions seem to follow my rationalization. I could not find one person who bought a piston-powered aircraft for an investment but plenty who bought for business use and even a few — very few — who bought for personal recreation. No discoveries were noted with values improving, but again, there were plenty of sales.

I have been with the Bluebook for a dozen years now. Reporting on values would be difficult if not for the good support I get from all of you in the trenches making transactions happen. My sincere thanks and gratitude.

Jet

Bluebook-at-a-glance

Increased — 3

Decreased — 534

Stable — 378

Early model Citation Xs were down this quarter. The Citation Mustang gained $100,000 when compared to the winter quarter. The late-model, long-range, large-cabin-class business jets remained stable for yet another quarter. Mid-range cabin business jets were off slightly again this quarter. Check your Bluebook for specifics.

Turboprop

Bluebook-at-a-glance

Increased — 0

Decreased — 70

Stable — 530

The turboprop market displayed little movement in values when compared to the previous quarter. Prices, still softer than previous reporting periods, were not eclipsed by the sales volume of aircraft.

Multi

Bluebook-at-a-glance

Increased — 12

Decreased — 38

Stable — 605

In the multi-engine category, sales reports were better than what Bluebook received for the previous quarter. Quantity was higher while values remained fairly stable.

Single

Bluebook-at-a-glance

Increased — 133

Decreased — 280

Stable — 2095

There was a slight increase in values of the Beechcraft Bonanza 36 series. Reported retail values were slightly higher than the winter Bluebook values. Take a look in the Bluebook to see if your aircraft got the positive bump in value this quarter. Ag piston aircraft values increased this reporting period as well.

Helicopter

Bluebook-at-a-glance

Increased — 33

Decreased — 79

Stable — 942

This market is all about time and condition. Overall, rotary market sales have been nearly the same in the value range when compared to recent Bluebook retail values.

Aircraft Bluebook–Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1913.

[Go to Charts.]

CHARTS — MARCH 8, 2011

Tuesday, March 8, 2011 at 10:00AM

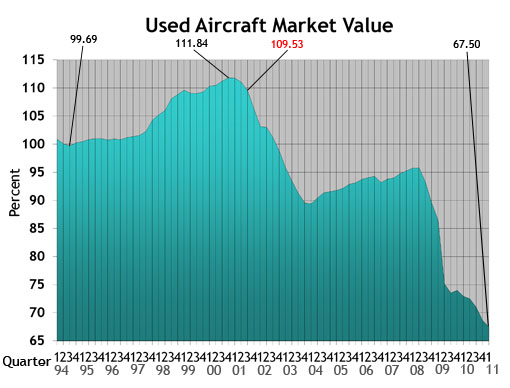

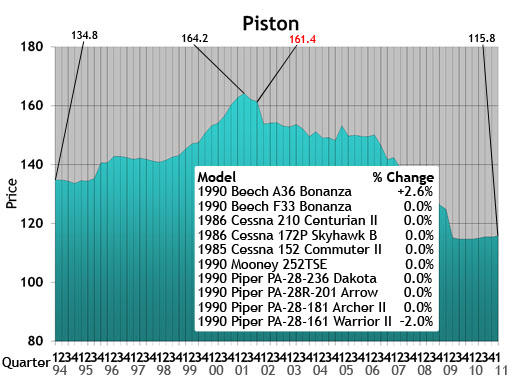

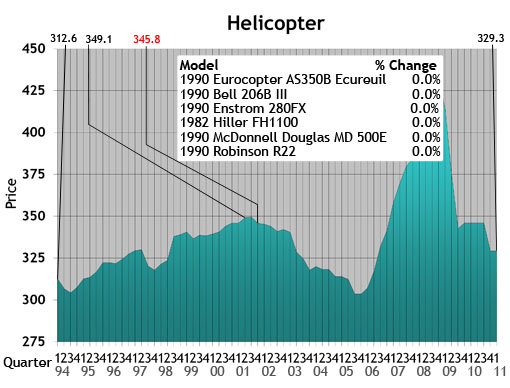

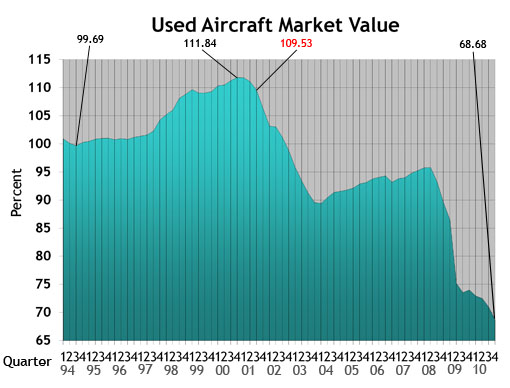

Tuesday, March 8, 2011 at 10:00AM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

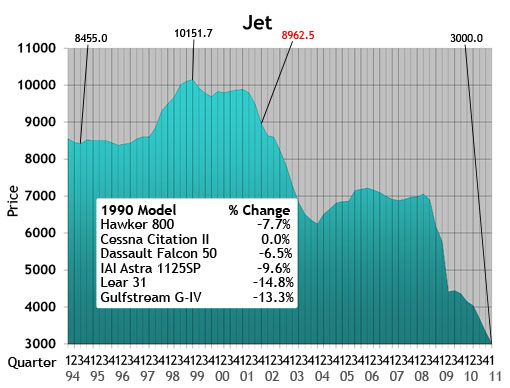

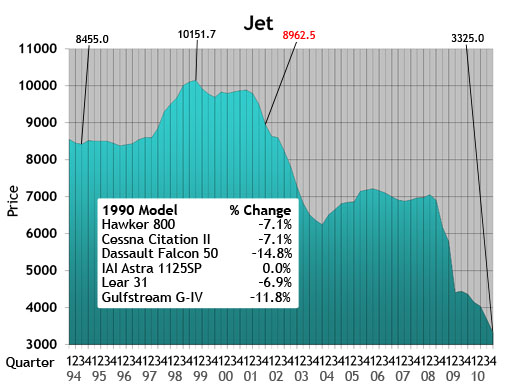

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

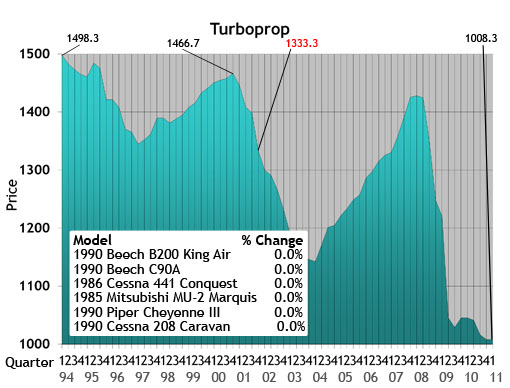

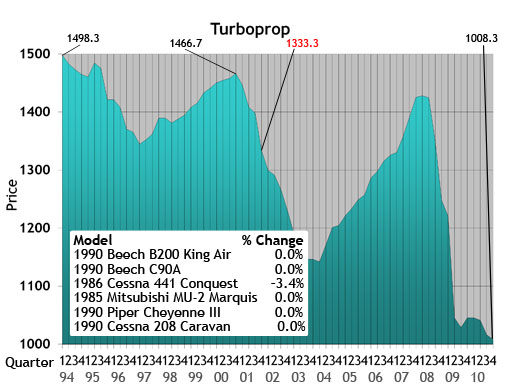

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

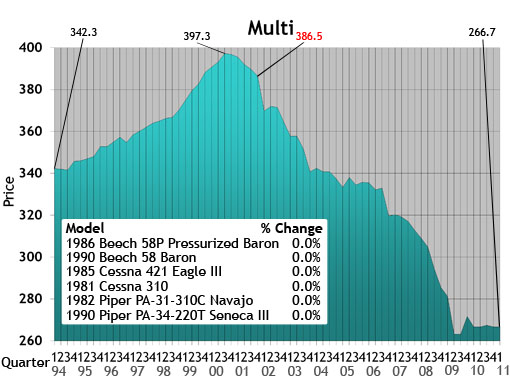

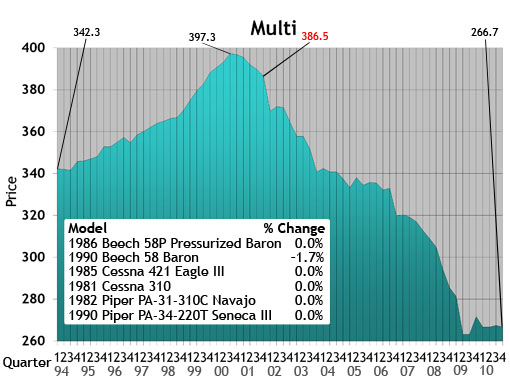

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

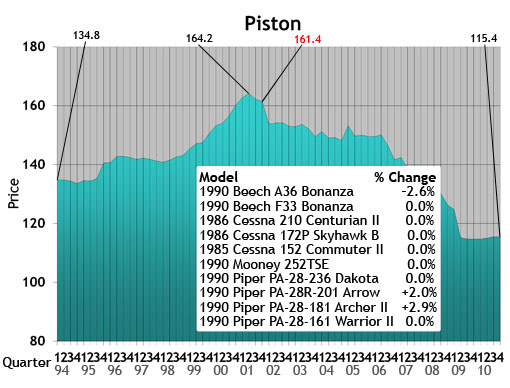

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

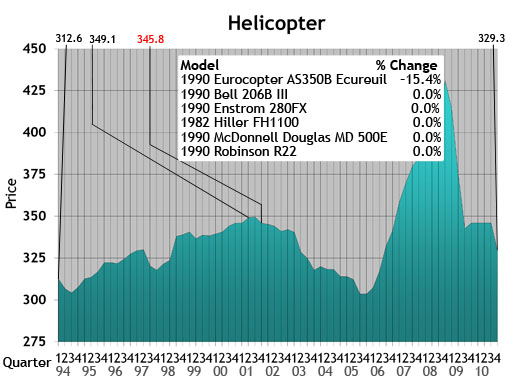

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

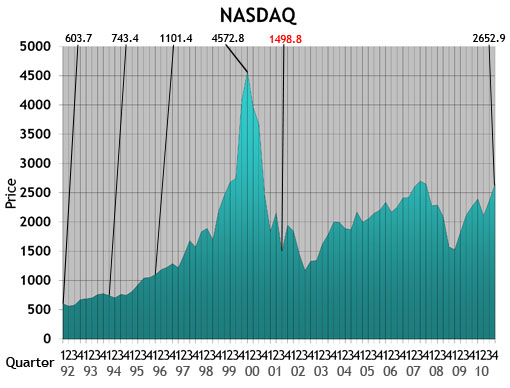

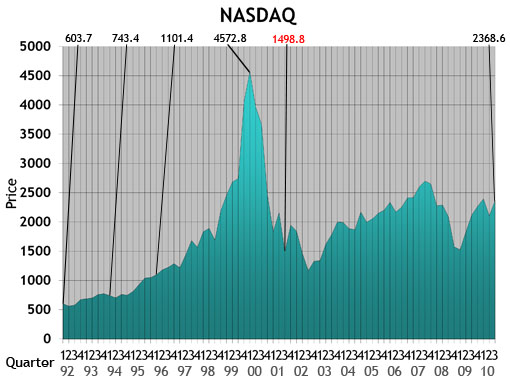

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

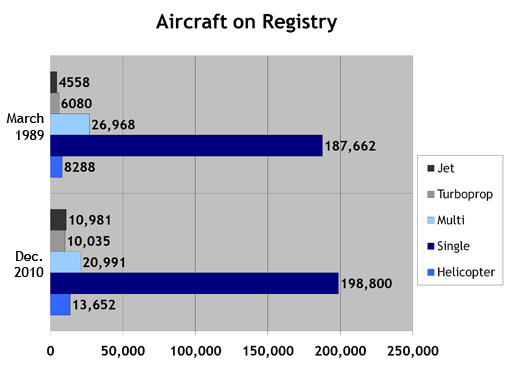

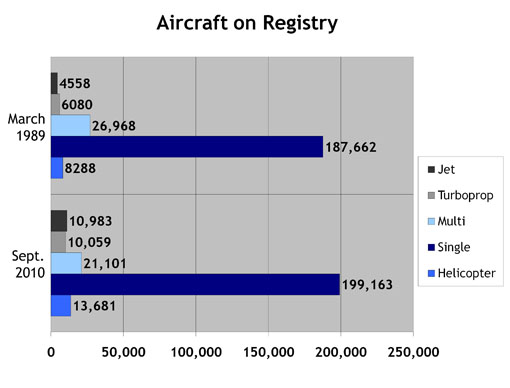

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

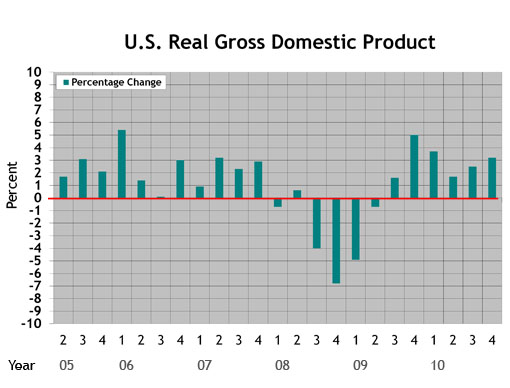

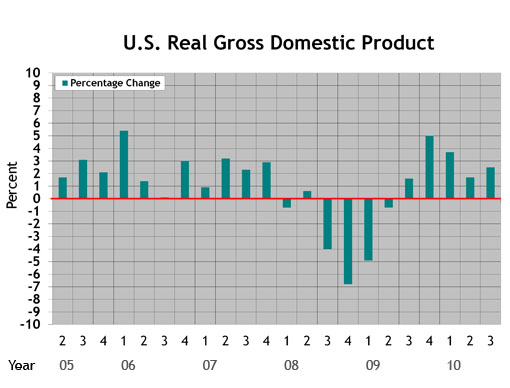

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

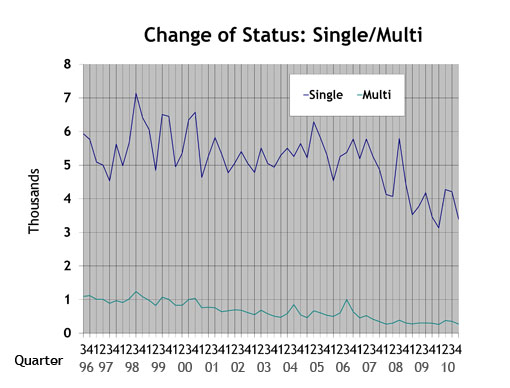

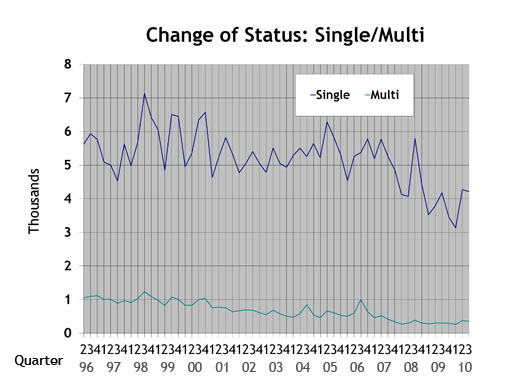

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

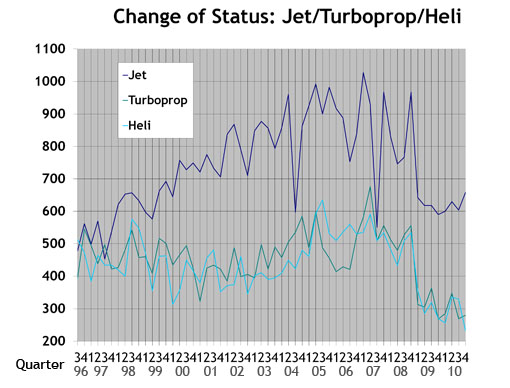

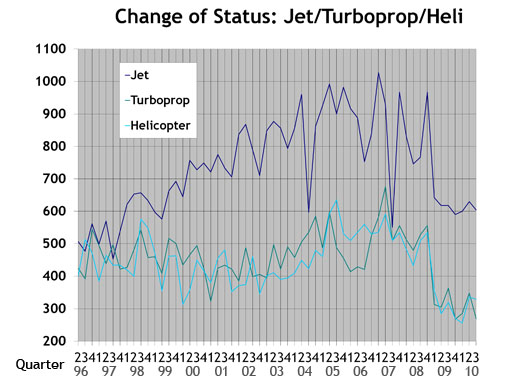

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

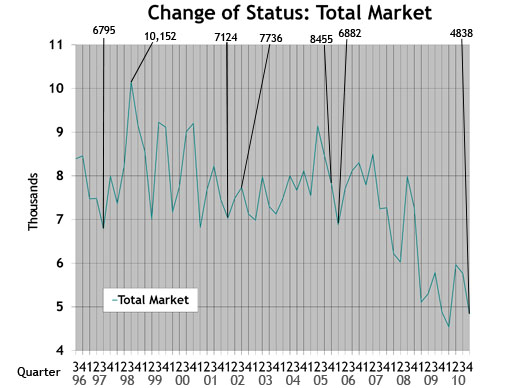

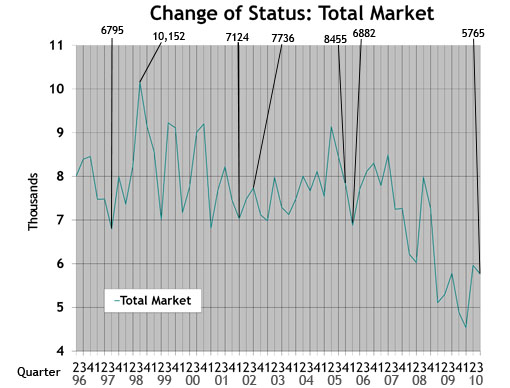

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Beech,

Beech,  Cessna,

Cessna,  Hawker,

Hawker,  Piper,

Piper,  helicopter,

helicopter,  jet,

jet,  multi,

multi,  piston,

piston,  pre-owned aircraft,

pre-owned aircraft,  turboprop,

turboprop,  used aircraft,

used aircraft,  values in

values in  Charts

Charts PRE-OWNED AIRCRAFT TRADING CONTINUES AT MODEST PACE

Friday, December 10, 2010 at 10:44AM

Friday, December 10, 2010 at 10:44AM Vol. 23, No. 4 | Dec. 10, 2010 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Trading in the pre-owned aircraft market continued at a modest pace as the third quarter came to a close and aligned itself on fourth-quarter activity for 2010.

Inventories available for sale grew slightly. Also noteworthy was the decrease of aircraft being sold with minimal time-in-market exposure. Days on market were significantly higher, which allowed a better opportunity to fetch maximum value in current market conditions. Time and condition also contributed to being a variable in the equation. Well-equipped, ready-to-fly aircraft had the largest audience of interest. Price competition remained limited. Sale prices continued in a downward trend or remained stagnant according the particular model group.

Several noted outside indicators have a relationship to the health of the pre-owned aircraft market. The General Aviation Manufacturers Association (GAMA) reported that shipments of turboprops and business jets manufactured worldwide were down when compared to the same time frame in 2009. Large fleet sales, such as those announced by Embraer recently, will have a future impact on pre-owned inventories when new deliveries replace current aircraft.

On other economic fronts, the $600 billion Federal Reserve QE2 (second round of quantitative easing) has yet to be observed as an action that will create growth in the business aviation sector.

On related business fronts, brokers dealing with the sale of corporations and businesses are reporting more activity with transactions closing after a long drought. Opportunities to do business are again starting to flourish.

Jet

Bluebook-at-a-glance

Increased — 14

Decreased — 502

Stable — 370

Bombardier Global Express experienced a $1 million upward trend for select model years. Bombardier Challengers were trending downward for the most part. Late-model Gulfstream G-550s were reported with a $1 million positive trend when compared to the fall Aircraft Bluebook. The Citation X was off a half million while the Sovereign was also down about $400,000. Depending on the model, most Dassault Falcons were also off when compared to the last quarter. The Hawker 800 was down $300,000. Light jets, such as the Cessna 525 were generally trending downward. Legacy Citation aircraft, such as the Citation II, were also off by about $100,000.

Turboprop

Bluebook-at-a-glance

Increased — 40

Decreased — 111

Stable — 444

The DeHavilland Twin Otter DHC-6 again trended upward when compared to the previous quarter. The Piper Meridian PA 46TP was raised $100,000 for the winter Bluebook. Select model years of the Piaggio P180 were also up in value. Legacy aircraft, such as the Cessna Conquest and Fairchild Metro, were down for this reporting period. Select late-model Beechcraft King Airs were also down. The majority of turboprop aircraft reported in Bluebook remained stable.

Multi

Bluebook-at-a-glance

Increased — 14

Decreased — 106

Stable — 534

Positive gains were limited for the multi engine category. Select 340s and 414s were up about $5000. The Twin Commander Fuji 700 increased by $10,000. Most Beech Barons were off about $5000. Select Piper Twins were also down an average of $5000. Values for the majority of the multi engine category remained unchanged.

Single

Bluebook-at-a-glance

Increased — 323

Decreased — 261

Stable — 1913

Bellanca experienced some positive gains. Average retail prices for select models were up slightly from the previous quarter. See the Bluebook for details.

Select legacy Cessna and Piper singles also had minor increases when compared to the previous quarter. The majority of the single engine market segment remained unchanged.

Helicopter

Bluebook-at-a-glance

Increased — 20

Decreased — 197

Stable — 831

The Bell 205 trended upward for the winter edition of Aircraft Bluebook. The Enstrom 480 also improved in retail value when compared to the previous quarter. The majority of the helicopter segment remained unchanged.

Aircraft Bluebook–Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1913.

[Go to Charts.]

CHARTS — DEC. 10, 2010

Friday, December 10, 2010 at 10:27AM

Friday, December 10, 2010 at 10:27AM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

U.S. Real Gross Domestic Product (updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product (updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

PRE-OWNED AIRCRAFT TRANSACTIONS INCREASE WHILE VALUES DECREASE

Wednesday, September 1, 2010 at 12:00PM

Wednesday, September 1, 2010 at 12:00PM Vol. 23, No. 3 | Aug. 18, 2010 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

There should be some optimism in our industry.

Buyers and sellers are finally coming to terms with what the market will bear for a given aircraft. And with that, the pre-owned aircraft market is seeing more completed deals. The gridlock of available inventory is starting to show some movement.

Values, on the other hand, remain soft with few signs of recovery.

Some of the factors that could be making an indirect impact on values relate to finance. Major lenders are adapting to the 20-year rule. That is, the age of the aircraft and term of the loan cannot exceed 20 years. Prior to the economic meltdown, it was a 30-year rule. Of course, there are exceptions to every rule, but this 20-year rule will continue to have a softening effect on value in the pre-owned market.

Another factor that might have a driving effect is the increase in cash buyers. Cash is a hard snare to turn away from if you are selling an aircraft. In return, the cash buyer will demand exceptional equipment at a discounted price.

To a lesser extent, aircraft foreclosures might have an impact on the industry. Time and condition do account for values in the marketplace. If an aircraft is sold outside the box of reason, then civil litigation will probably ensue.

You, the market itself, the live dynamics of what makes this whole process happen, may have your own opinion too. Let us know your thoughts.

Jet

Bluebook-at-a-glance

Increased — 3

Decreased — 595

Stable — 281

Late-model, large-cabin aircraft are retaining value. The medium-range business jet, such as the Lear 45 series and the Hawker 800 series, continues to show signs of normal depreciation.

Citation X and the Sovereign were off from last quarter. Bombardier Global Express and the 5000 remained steady while the Challenger 604 declined. The Falcon 7X held steady, but the Falcon 50 was down. Values for late-model Gulfstreams held steady, yet values for earlier models were off.

Turboprop

Bluebook-at-a-glance

Increased — 25

Decreased — 135

Stable — 434

The ag market still rules in this category because the very boutique and limited markets hold on to value.

One surprise this quarter is the DeHavilland Twin Otter DHC-6. Limited inventories, great demand and a new production line have brought a burst of life into the values of these aircraft. Check the values in the new fall 2010 release of Aircraft Bluebook.

Late-model King Airs were down slightly.

Multi

Bluebook-at-a-glance

Increased — 12

Decreased — 26

Stable — 618

Time and condition will play the upper hand in this market, especially when dealing with aging aircraft. Anything more than 20 years old in this market is a senior citizen. For the most part, values for this segment remained unmoved when compared to the previous quarter.

Single

Bluebook-at-a-glance

Increased — 217

Decreased — 200

Stable — 2078

As with their twin brethren, time and condition also have the upper hand in supporting value. Do not just look at the sale price. Also pay close attention to restorations, upgrades and modifications.

For the most part, the single category was stable.

Helicopter

Bluebook-at-a-glance

Increased — 57

Decreased — 221

Stable — 761

Helicopters are continuing to show some signs of stabilization with the majority of this segment remaining unchanged in reported values when compared to the previous quarter.

Visit us at the 2010 NBAA Annual Meeting & Convention

Aircraft Bluebook will be in booth No. 7626 at NBAA 2010 on Oct. 19-21.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1913.