Entries in used aircraft (50)

CHARTS — MARCH 1, 2012

Tuesday, February 28, 2012 at 12:15PM

Tuesday, February 28, 2012 at 12:15PM CURRENT MARKET STRENGTH

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

Click to View Full Size ChartCMS represents an aircraft’s current strength in the market. An A+ rating indicates the aircraft is enjoying a very firm market. Prices for an A+ aircraft are steadily rising, and holding times are very short or nonexistent. At the opposite end of the spectrum, a C- aircraft is one experiencing a very soft market. Its price is commonly discounted, and it often sets on the ramp in excess of eight months before selling. It is important to remember that Current Market Strength is not a forecast. It is valid only at Marketline’s effective date of release.

MARKETLINE CHARTS

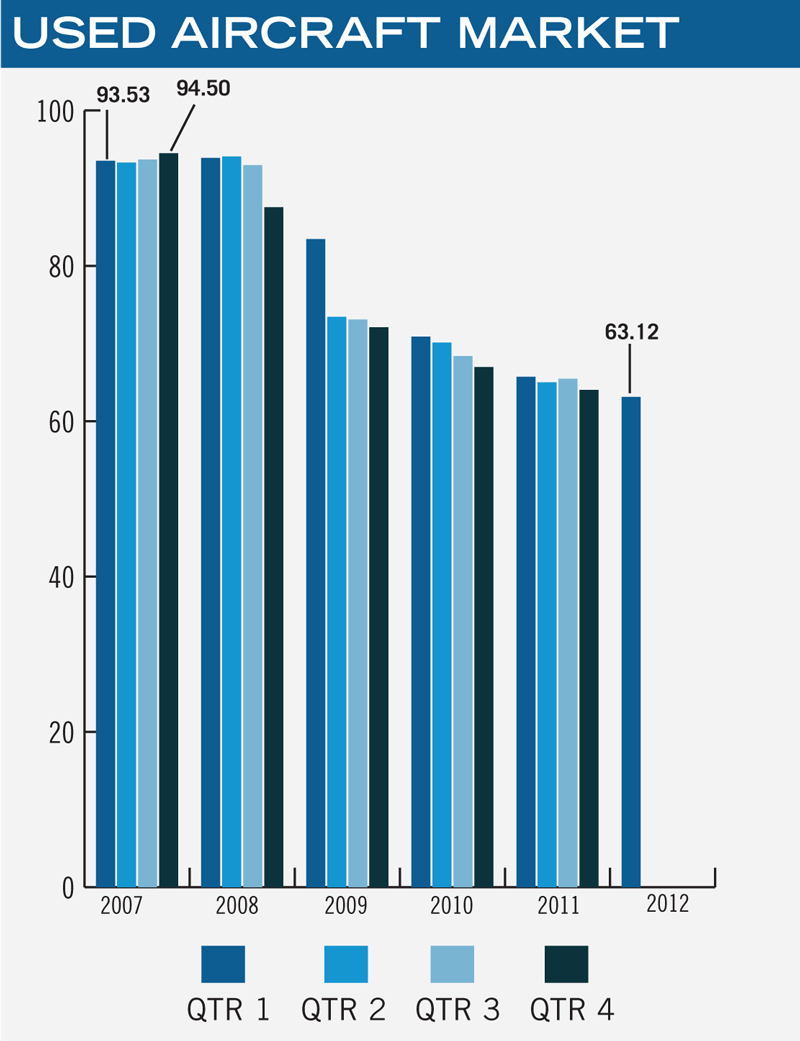

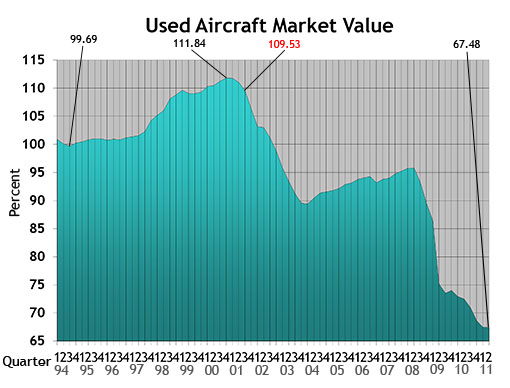

All of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

All of the listed aircraft have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods can be concluded as the percentage of change.

Click any chart to view it Full Size

Click here to download a PDF of the full Marketline Newsletter, including articles and all Charts.

DISPARATE PRE-OWNED AIRCRAFT MARKETS EMERGE

Tuesday, September 13, 2011 at 11:45AM

Tuesday, September 13, 2011 at 11:45AM What Goes Around Comes Around During Economic Recoveries

Vol. 24, No. 3 | September 13, 2011 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

Pick your adjective.

A wide disparity exists in today’s pre-owned business aircraft market, and just about any adjective will accurately describe some part of the market.

Great can be used to describe late-model large-cabin global business jets, which include models such as the Global XRS, Dassault Falcon 7X and Gulfstream G550.

Then there is the awful when dealing with a legacy business jet punching through its 30th anniversary of service.

For a while now, there have been at least two distinct markets. This scenario is not news, yet many in this industry seem puzzled about market dynamics.

Why does the pre-owned market appear to be good, bad and confused? The answer is the closed traffic pattern around the economy. As the recovery stumbles along, confidence remains shaky. We can’t break out of the pattern. To make matters murkier, the preseason presidential election rallies are in full swing with the all-out campaigns next. Oh joy.

For this edition of Marketline, I could not find an angle that hasn’t already been explored by someone else. I went to the Bluebook archives and pulled out an Aircraft Bluebook Marketline from 1992 for inspiration, and I think I have found a good way to predict what’s next in the economy. Even in this lethargic economic recovery, what goes around comes around. Historically, there has always been an economic recovery followed by a peak and then another slow down.

Marketline has done a pretty good job at reporting trends. The pre-owned market knows its position in this cycle. Someone out there is bound to make the calculated decision to buy now rather than later realizing the upswing is on the way.

Jet

Bluebook-at-a-glance

Increased — 9

Decreased — 353

Stable — 561

The jet segment experienced few positive moves. Early Citation Sovereigns edged upward. The Gulfstream G550 saw the greatest value increase — by more than $2 million.

Decreases affected all categories. The majority of the jet market was reported as stable, though.

Turboprop

Bluebook-at-a-glance

Increased — 23

Decreased — 74

Stable — 508

The turboprop market continued to demonstrate signs of stability, which are good signs of an economic recovery in progress. Turbine-powered ag planes continue to be nearly nonexistent in the resale market. Late-model twins, such as the Beech King Air 350i and the B200GT, likewise are nearly unavailable. Inventories available for sale held in check or slightly increased when compared to the previous quarter.

Multi

Bluebook-at-a-glance

Increased — 58

Decreased — 17

Stable — 582

Single

Bluebook-at-a-glance

Increased — 144

Decreased — 225

Stable — 2174

The piston segment has had the least amount of price change activity. Even though sale prices were stationary when compared to last quarter, transactions were on the rise. (Refer to the graphs that follow.) Bargain hunters also appeared to have given up their quest for the deal of the day and have taken their place on the fence to wait and see. Wait too long, and it might cost more to buy tomorrow.

Helicopter

Bluebook-at-a-glance

Increased — 65

Decreased — 92

Stable — 910

Helicopters are continuing to show some signs of stabilization. Reported values for the majority of this segment remained unchanged when compared to the previous quarter. The Robinson R44 and R22 continued to edge upward about $8000 to $9000 in retail value.

Aircraft Bluebook – Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1956.

[Go to Charts.]

CHARTS — SEPT. 13, 2011

Tuesday, September 13, 2011 at 11:18AM

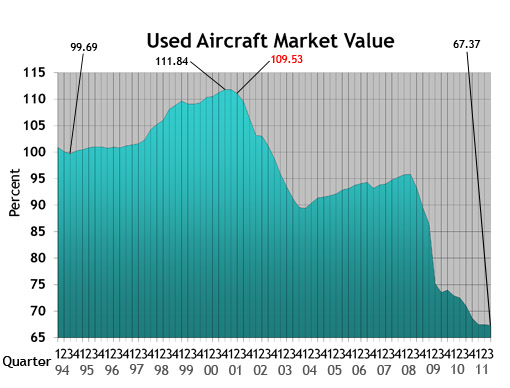

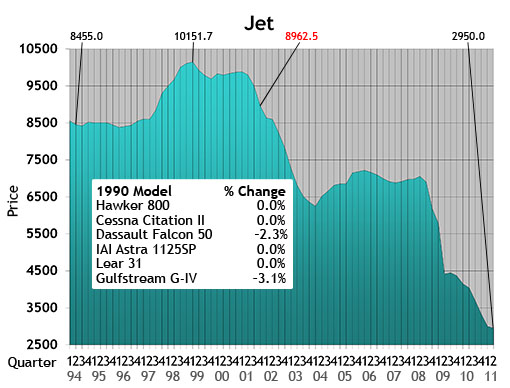

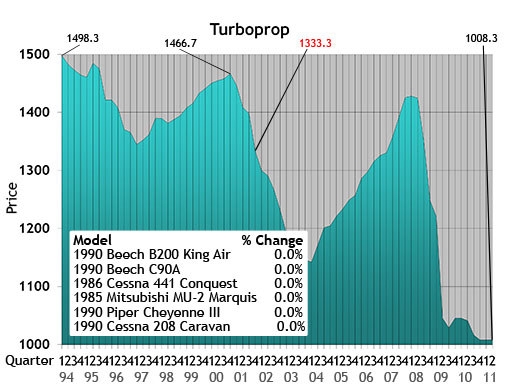

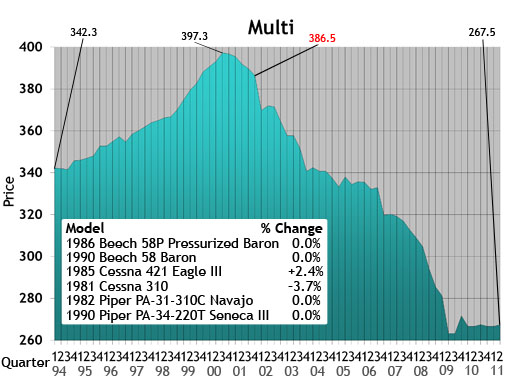

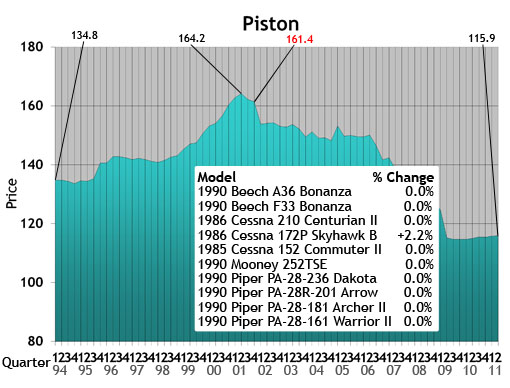

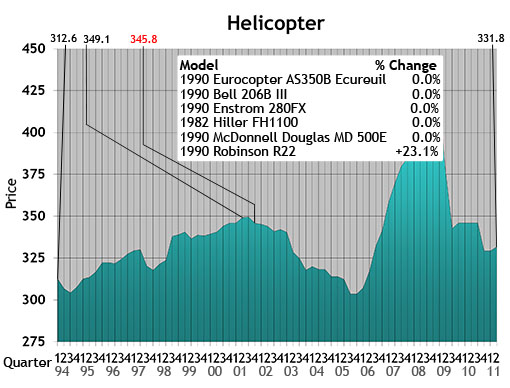

Tuesday, September 13, 2011 at 11:18AM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

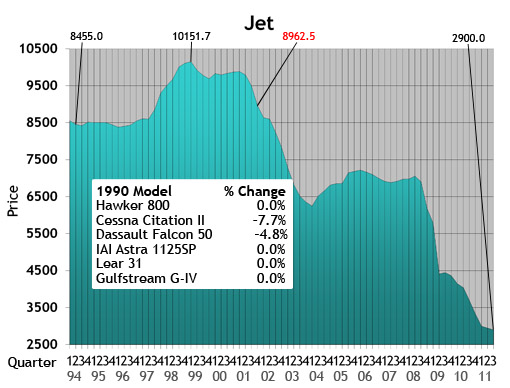

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

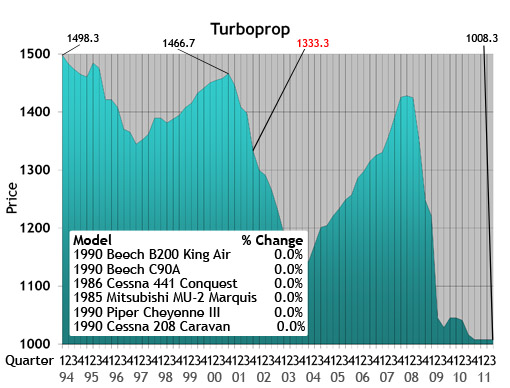

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

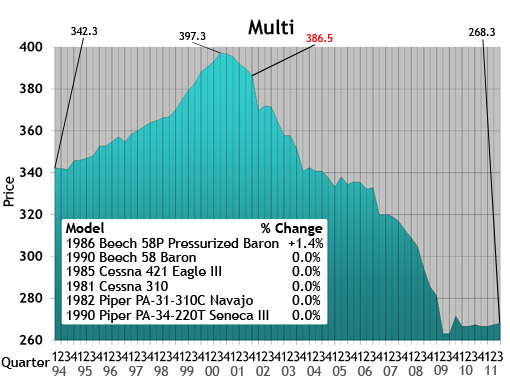

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

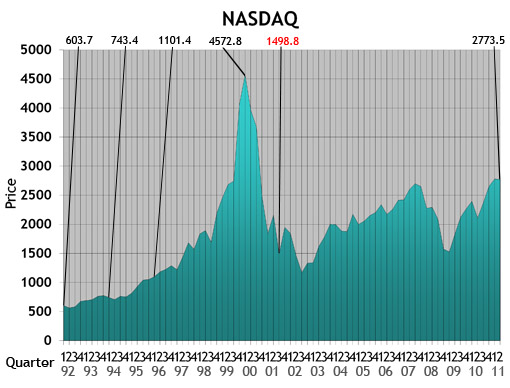

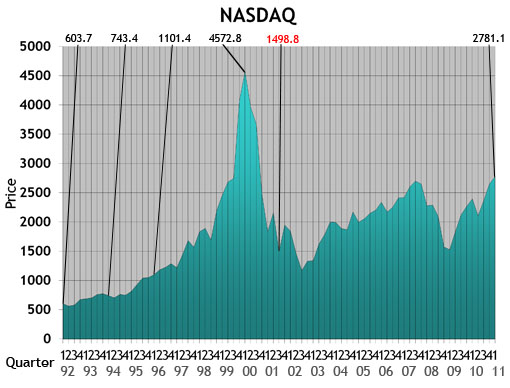

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

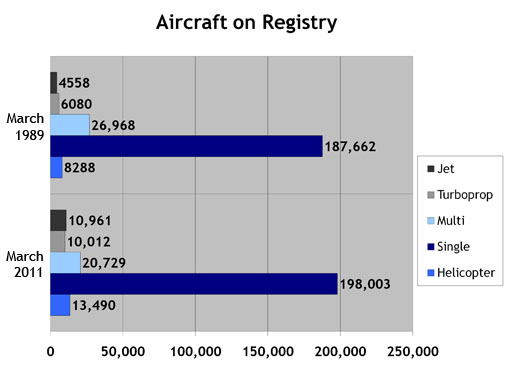

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

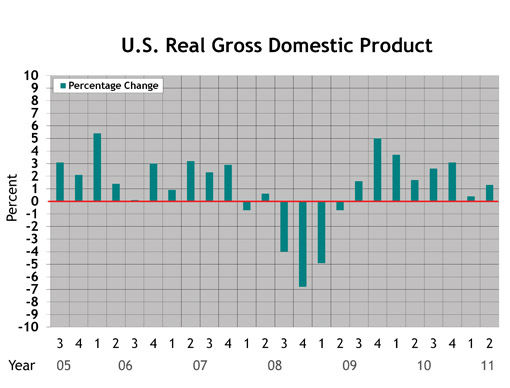

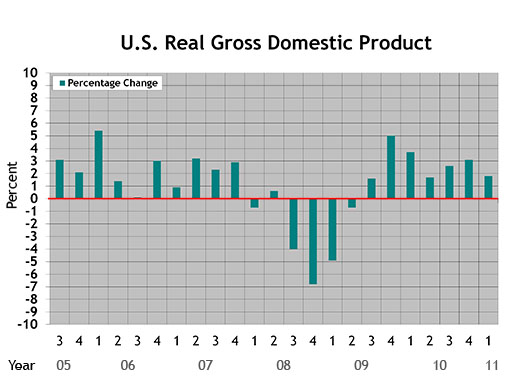

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

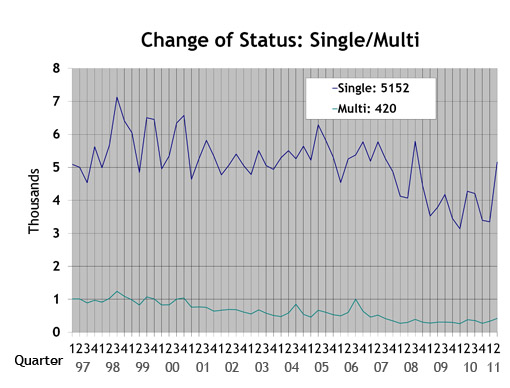

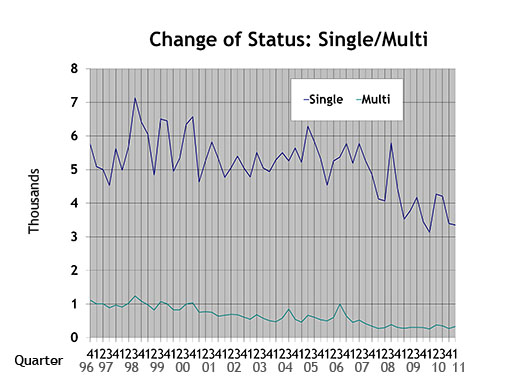

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

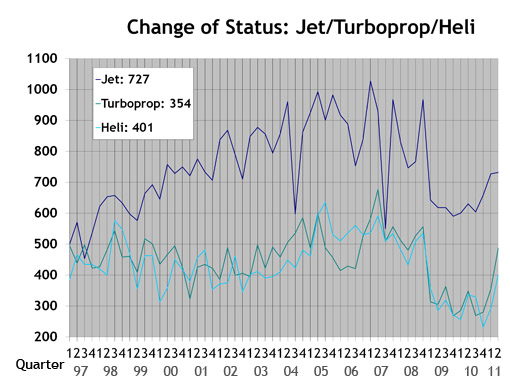

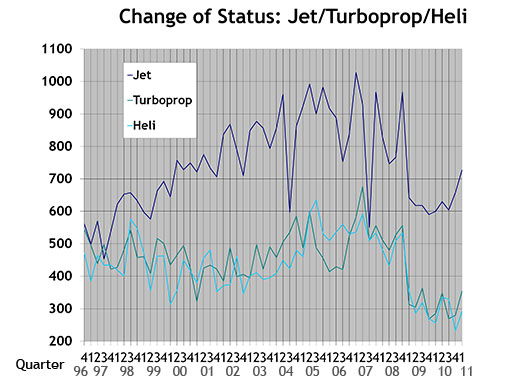

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

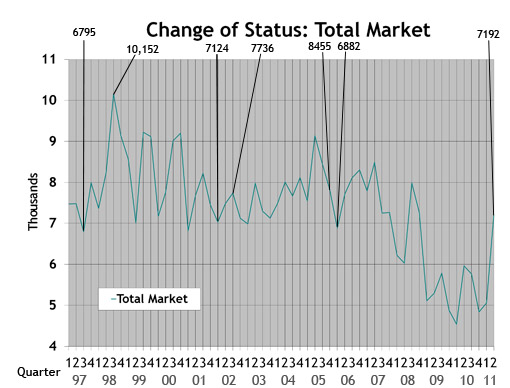

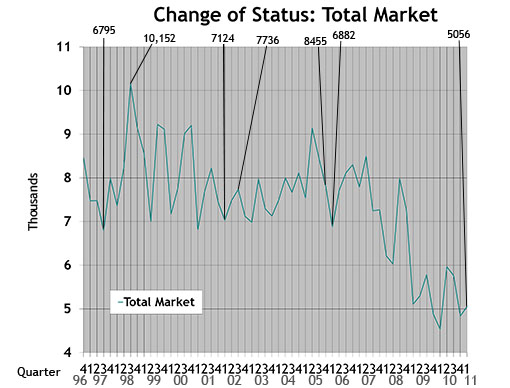

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

BUSINESS AIRCRAFT MARKET RECOVERING DESPITE ECONOMIC WOES

Monday, June 6, 2011 at 9:07AM

Monday, June 6, 2011 at 9:07AM Vol. 24, No. 2 | June 6, 2011 | Go to Charts

by Carl Janssens, ASA | Aircraft Bluebook — Price Digest

News networks these days have few positive perceptions when reporting on the U.S. economic recovery. Stories cite home foreclosures, a lack of jobs and the price of gas as prospective signs of a weak economy.

While doubts persist about the United States in an economic recovery, the business aviation sector is not following suit. For instance, late-model, large-cabin, long-range aircraft are selling at or above values published in the Aircraft Bluebook.

While North American business aircraft transactions have been lackluster, increasing sales on other continents are supporting the overall business aircraft market. Whatever the reason, inventories for late-model aircraft for sale continue to shrink. This can be interpreted as an indication of values held in check.

New aircraft models designed and equipped with the latest technology are breathing new life into the industry. Legacy aircraft, on the other hand, will never experience an economic comeback. Darwin’s “survival of the fittest” affects business aircraft, too.

While the U.S. economy still struggles to make a better comeback, business aviation has wheels in the well for the long haul.

Jet

Bluebook-at-a-glance

Increased — 41

Decreased — 298

Stable — 583

Lear 35s are now being reported with MSP, and values trended upward due to the reported equipped price in Bluebook. Late-model Bombardier Global XRSes gained value by $1 million when compared to the previous quarter.

Turboprop

Bluebook-at-a-glance

Increased — 1

Decreased — 93

Stable — 511

Like the rest of the industry, turboprops continued to demonstrate some good signs of stability. Payload, range and cost of operation will be key factors to watch. As competition for commodities becomes more aggressive on a global level, bringing new services to remote regions of the world will also play a role in continued stability in this market segment.

Multi

Bluebook-at-a-glance

Increased — 10

Decreased — 32

Stable — 616

Single

Bluebook-at-a-glance

Increased — 148

Decreased — 335

Stable — 2056

The multi and single markets are some of the best indicators of stability. A majority of these aircraft are represented by personal acquisition. Buyers and sellers agree on price, and financial institutions fund these transactions.

Helicopter

Bluebook-at-a-glance

Increased — 69

Decreased — 122

Stable — 865

The Robinson R44 and R22 gained slightly in value when compared to the previous quarter. The majority of models remained stable for another quarter.

Aircraft Bluebook–Price Digest here for you

Please contact Aircraft Bluebook if you have any specific concern in a particular aircraft market. We will be happy to share with you the most up-to-date information available for your market segment. Call us toll-free at 877-531-1450 or direct at 913-967-1913.

[Go to Charts.]

CHARTS — JUNE 6, 2011

Monday, June 6, 2011 at 8:44AM

Monday, June 6, 2011 at 8:44AM  Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Used Aircraft Market: This chart displays each model's quarterly value in relationship to its average equipped price at the inception of the aircraft. The study begins in the spring quarter of 1994 and includes the Jet, Turboprop, Multi, Piston and Helicopter. For all charts, the red number indicates the first reporting date after 9-11.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Jet: The jet chart depicts the average price (in thousands) of the six 1990s jets listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Turboprop: The turboprop chart depicts the average price (in thousands) of a 1985, 1986 and four 1990 turboprops listed in the box.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Multi: The multi chart depicts the average price (in thousands) of the six multi models listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Piston: The piston chart depicts the average price (in thousands) of the 10 pistons listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

Helicopter: The helicopter chart depicts the average price (in thousands) of the six helicopters listed in the box. Each model’s year will precede the name of the aircraft.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

NASDAQ: This ratio scale chart depicts the change for the NASDAQ daily average from quarter to quarter beginning at the end of the first quarter of 1992. Each data point represents the closing daily average on the last trading day of each quarter. This study originates in the first quarter of 1971.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

Aircraft on Registry: The Aircraft on Registry chart depicts the number of aircraft reported in Aircraft Bluebook that are listed on FAA records and considered to be in the U.S. inventory.

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

U.S. Real Gross Domestic Product (criteria updated Aug. 27, 2010): This graph represents real gross domestic product measured by the U.S. Bureau of Economic Analysis. Each data point represents the BEA's final figure or latest estimate of the quarter-to-quarter seasonally adjusted annual rates of change in real GDP "based on chained 2005 dollars." The study begins with the second quarter in 2005.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Single/Multi: The blue line in the Single/Multi chart depicts change-of-ownership data for singles. The black line represents multis.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Jet/Turboprop/Heli: The black line in the Jet/Turboprop/Heli chart represents change-of-ownership information for jets. The blue line depicts turboprops, and the gray line represents helicopters.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.

Total Market: Depicts change-of-ownership data for all aircraft included in the Aircraft Bluebook. The numbers are from the FAA Registry. Gliders, homebuilts, airliners and other aircraft not found in the Bluebook are not included in this study.