Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Entries by Aircraft Bluebook Marketline (178)

Dassault Falcon 7X Aircraft Bluebook At-A-Glance

Thursday, February 28, 2019 at 2:21PM

Thursday, February 28, 2019 at 2:21PM

Aircraft Bluebook At-a-Glance has reviewed the current market status of the Dassault Falcon 7X business jet. Research for this study was obtained in part from Aircraft Bluebook, Aircraft Bluebook’s Historical Value Reference, the FAA’s registry web site and various trade services.

Demand

The Falcon 7X fleet currently is approximately 278 aircraft. At the time of this writing, approximately 15 Falcon 7X aircraft, representing approximately 5.4% percent of the fleet, were reported for sale. Average time on market for wellequipped aircraft in good maintenance condition appears to be around 200 days. Over the last year approximately 30 to 35 aircraft appear to have transacted.

Pricing

Current offerings for the Falcon 7X range from low-$18 million to $30+ million. Airframe time varies from several hundred hours to greater than 4,000 hours, depending on the year-model. Equipment (especially 2020 mandate items), time/condition and engine maintenance programs can significantly affect time on market and...

Download the full winter 2018 issue of Aircraft Bluebook Marketline to read more.

Looking Back at 2018: Business Aircraft

Thursday, January 17, 2019 at 10:26AM

Thursday, January 17, 2019 at 10:26AM A more positive note crept back into business aviation in 2018 as new models key to the market’s recovery checked off program milestones. We took a look at events in business aviation in 2018.

Aircraft Values and Indicators

Thursday, December 6, 2018 at 3:38PM

Thursday, December 6, 2018 at 3:38PM Large Jet

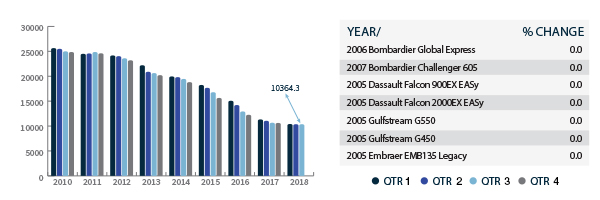

The Large Jet chart depicts the average price (in thousands) of the seven jets listed. Each model’s year will precede the name of the aircraft.

Medium Jet

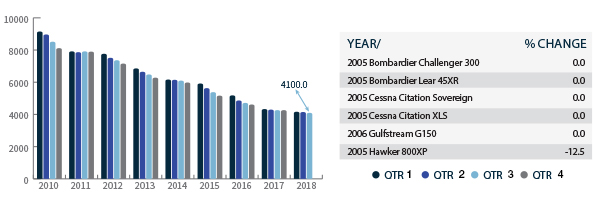

The Medium Jet chart depicts the average price (in thousands) of the six jets listed. Each model’s year will precede the name of the aircraft.

Download the full fall 2018 issue of Aircraft Bluebook Marketline to read more.

Subscribe to the Aircraft Bluebook Marketline newsletter.

Situational Awareness

Thursday, December 6, 2018 at 2:33PM

Thursday, December 6, 2018 at 2:33PMGeneral Dynamics Buys Nordam Nacelle Line for Gulfstreams

Gulfstream maker General Dynamics (GD) said Oct. 1 it acquired the Nordam Group’s nacelle manufacturing line for the Gulfstream G500 and Gulfstream G600, ending a drama that saw the latter file for bankruptcy and threats arise to one of industry’s high-profile business jets.

GD said it will continue to operate the line at Nordam’s Tulsa, Oklahoma, facility. A federal bankruptcy judge approved the transfer Sept. 26, clearing the way for the acquisition. Terms will not be disclosed, the company added.

According to GD, a deal for the line was filed in court in September. What is more, GD had been operating the line “since early September” under a sublease as parties worked to address Nordam’s bankruptcy, filed July 22.

“Gulfstream has a 60-year history of manufacturing and product excellence that will serve our customers well as we assume responsibility for nacelle production,” Gulfstream President Mark Burns said. “The manufacturing of this component is firmly in our wheelhouse, especially since we also manufacture the wings and empennages for these aircraft.”

Family owned Nordam filed for bankruptcy protection after a protracted contract dispute with Pratt & Whitney Canada over the PW800 nacelle system used in G500s and G600s. The company said the bankruptcy was due to this dispute only and other programs were not affected.

Download the full fall 2018 issue of Aircraft Bluebook Marketline to read more.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Business Aviation Trends

Thursday, December 6, 2018 at 3:30PM

Thursday, December 6, 2018 at 3:30PM All of the aircraft included in the aircraft segment graphs on the following pages have a composite score that is presented in the Used Aircraft Market graph. Data points are represented in relationship to the respective new delivered historical price that is equal to 100%. The measure of change is reported in the actual percentage of value in relation to new. The delta between reporting periods...

Download the full fall 2018 issue of Aircraft Bluebook Marketline to read more.

Subscribe to the Aircraft Bluebook Marketline newsletter.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off | Profile: Bombardier Learjet 75

Thursday, December 6, 2018 at 3:19PM

Thursday, December 6, 2018 at 3:19PM The Learjet 75 is a twin-engine business jet that is produced by Learjet, itself a subsidiary of Canadian manufacturer Bombardier. Despite the fact that Learjet’s parent company is Canadian— having been acquired by Bombardier on June 29, 1990— the company is based in Wichita, with production taking place at facilities located at Wichita’s Dwight D. Eisenhower National Airport. Along with the Learjet 70, the Learjet 75 was launched by Bombardier on May 14, 2012, at the European Business Aviation Convention and Exhibition, with both variants receiving FAA certification on Nov. 13, 2013. At the time of its launch, the Learjet 75—along with the Learjet 70—was promoted as including “a new modern design interior, a next generation cabin management system, the Vision Flight Deck with a state-of-the-art avionics suite, superior aircraft performance and low operating costs.” From a type certification standpoint, the Learjet 75 is based on the Model 45 Learjet, with it defined as being a Model 45 with a serial number in the 45-456 to 45-2000 range.

According to the FAA Type Certificate Data Sheet for the type, the maximum certified capacity of the Learjet 75 is 11, comprising the two required flight crew and nine passengers. Those passengers are accommodated in a cabin that is 19 ft. 10 in. long, 5 ft. 1 in. wide and 4 ft. 11 in. tall. Bombardier promotes...

Download the full fall 2018 issue of Aircraft Bluebook Marketline to read more.

Aircraft Bluebook Marketline | Comments Off |

Aircraft Bluebook Marketline | Comments Off |